Redefining the Landscape: Insights and Trends in Digital Audio Advertising

Digital audio advertising is undergoing a significant transformation, propelled by the swift expansion of digital media and changing consumer habits. As individuals increasingly turn to audio channels like streaming services, podcasts, and audiobooks for entertainment and information, advertisers have found a fertile ground for engagement.

Audio advertising thrives on its versatility, allowing consumers to listen while performing various activities without the need for visual engagement. This era of personalized, data-driven digital marketing, has enabled brands to craft highly tailored audio ads that resonate deeply without interrupting the user experience. Key platforms such as Spotify and Apple Music provide advertisers with a captive audience, maximizing the impact of their campaigns.

Furthermore, advancements in automation and programmatic advertising allow for precise, context-sensitive advertisements, enhancing both reach and relevance. The evolution of technology, including the advent of 5G, continues to optimize how audio content is delivered and consumed, promising a robust future for digital audio advertising where creativity and precision harmoniously blend.

Table of Contents

1. Navigating the Digital Audio Advertising Terrain

3. Overview of Digital Audio Advertising Market

4. Listening Habits and Preferences

5. Innovations and Future Directions: Evolving Opportunities

Navigating the Digital Audio Advertising Terrain

Digital audio advertising has come a long way since its nascent stages in the early 2010s, marked by the emergence of streaming services like Pandora and Spotify. As the user base for digital audio expanded, advertisers quickly recognized the potential to reach targeted audiences via these streaming platforms.

Initially, the scope of online audio advertising was relatively primitive, heavily reliant on display and pre-roll audio ads that lacked personalization. However, the domain has witnessed a significant transformation, driven by the proliferation of streaming services such as Spotify, YouTube Music, Apple Music, Amazon Music, and Tencent Entertainment Music. These platforms now employ sophisticated techniques like location-based, device, and demographic targeting, along with programmatic advertising to precisely engage selected audiences and personalize campaigns in real time.

With the continuous growth in streaming and podcast services and the rising popularity of smart speakers, digital audio advertising is set to become even more dynamic. Smart speakers, in particular, present a promising avenue for further innovation with the potential for voice-activated and integrated ads, enhancing user engagement and offering advertisers novel ways to expand their reach.

Defining Digital Audio Advertising

Digital audio advertising represents a modern way for brands to reach consumers immersed in audio experiences, whether they're jogging with a playlist or listening to a podcast during their commute. Unlike traditional radio or podcast ads, digital audio advertising is placed on platforms where the target audience's behavior can be directly influenced, making it highly effective for prompting specific consumer actions.

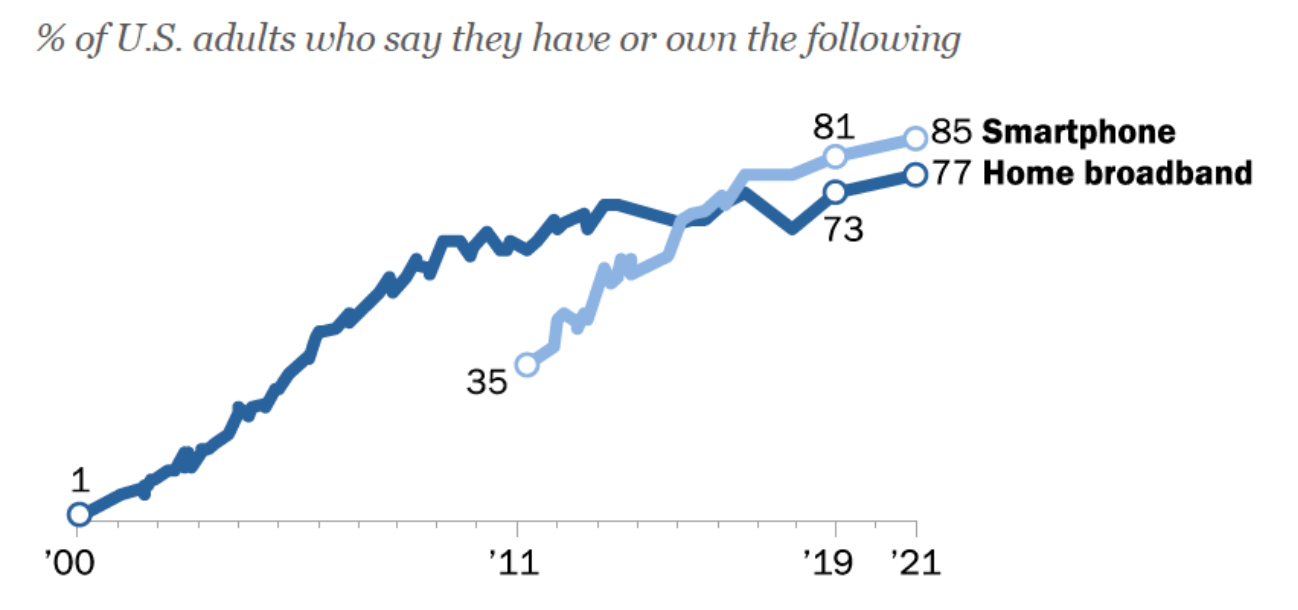

As smartphones become ubiquitous—85% of Americans owned one as of 2021, according to Pew Research—more consumers have continuous access to digital radio, podcasts, and music streaming services. These platforms are prime venues for programmatic audio ads and advertising, given their widespread use and the personal nature of audio consumption.

Today's audio advertising landscape is primarily dominated by three markets: podcasts, digital radio, and music streaming services. Each market demands unique audio formats, caters to distinct demographics, and leverages different types of programmatic audio advertising strategies, offering advertisers diverse ways to engage effectively with their audiences.

Market Analysis: Unveiling the Current Landscape

The landscape of audio advertising is defined by its split between traditional radio ads and digital audio formats, each catering to distinct segments of the advertising market.

Traditional Radio Advertising encompasses advertisements on terrestrial radio stations and networks, including both terrestrial radio broadcasting and satellite radio services primarily in the U.S. and Canada. This category employs a variety of spot formats such as classic spots background music only, live reads, content spots, and allonges.

It differentiates further into direct advertising, where businesses directly contact local stations, and indirect advertising, where national campaigns are managed through media buying agencies. This traditional form remains robust, driven by its longstanding presence and broad demographic reach.

On the other hand, Digital Audio Advertising represents a dynamic and rapidly growing sector, driven by the proliferation of streaming services for music and podcasts. This modern format includes advertising on both ad-supported versions of premium services and entirely ad-funded platforms.

Digital ads may appear as single spots, tandem spots, or specialized formats like sponsorships and infomercials, which can be either embedded directly into the sound effects the streams or dynamically inserted to target specific listener segments.

The digital audio advertising market focuses on B2B spending and is quantified by advertising spending, the number of users, and average revenue per user, excluding costs like agency commissions and production expenses. As the digital audio ads landscape continues to evolve, these platforms offer advertisers innovative ways to reach a targeted, engaged audience with personalized advertising solutions.

Insights into Market Data

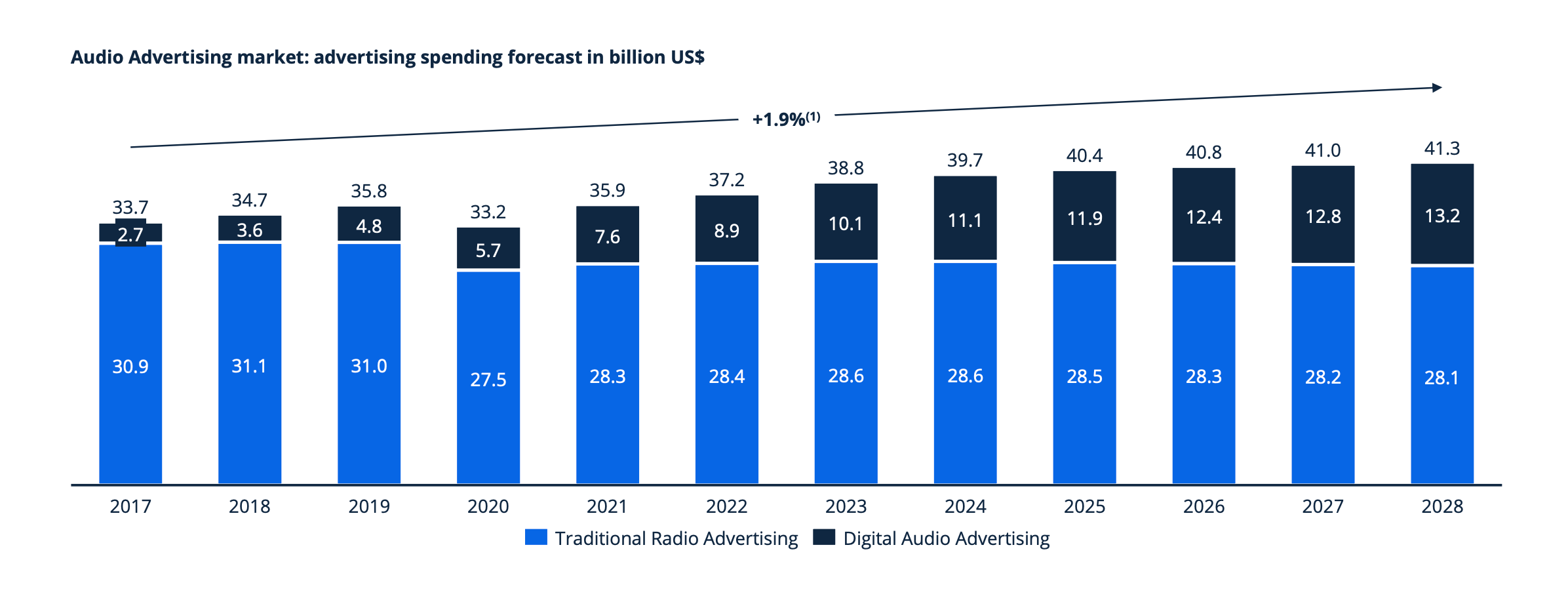

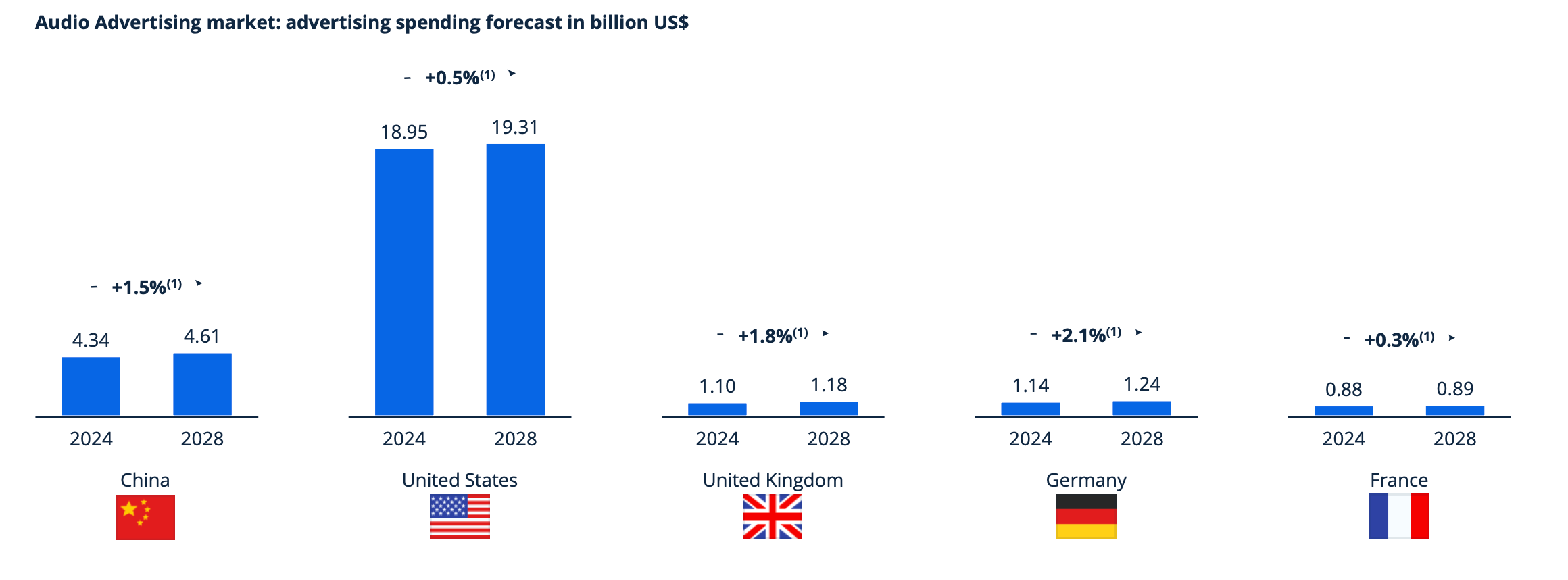

In 2024, audio advertising is poised to capture 3.67% of the total advertising market revenue, with projected spending reaching $39.73 billion, according to Statista research. Traditional Radio Advertising remains the most substantial segment, accounting for $28.60 billion of this total. The United States leads in ad spending, anticipated to generate $18.95 billion.

On average, advertisers are expected to spend $9.25 per listener in the traditional radio segment. The scope of this market primarily includes advertising conducted through terrestrial radio broadcasts and digital platforms, such creative services such as music and podcast and streaming audio services.

Notably, the data excludes revenue from banner or video ads that are only present in the web players of these services, highlighting a focused investment in audio-based advertising strategies.

Advertising Expenditure

In the realm of advertising expenditure, the audio advertising market is experiencing a nuanced growth pattern. The compound annual growth rate (CAGR) for audio advertising from 2017 to 2028 stands at 1.9%, signifying steady growth.

As of 2024, the Americas lead in ad spending with a total of $21.8 billion, driven predominantly by the United States, which accounts for $18.95 billion, more than half, of this expenditure. This places the U.S. at the forefront among selected countries, significantly ahead of others like Germany, which is seeing a moderate increase in ad spending with a 2.1% CAGR.

Notably, in 2024, digital audio ad spending per user has surpassed that of traditional and radio ads, indicating a shift in advertiser preference towards digital platforms.

This shift is further evidenced by the projected significant growth in digital audio advertising, which is expected to see a 15.5% CAGR, contrasting sharply with traditional radio advertising that is projected to experience a slight decline of -0.9% CAGR from 2017 to 2028. The decline in traditional radio is partly due to the rise in streaming and podcasts, which have increased the amount of ad-supported digital audio content, while traditional over-the-air radio has seen significant losses.

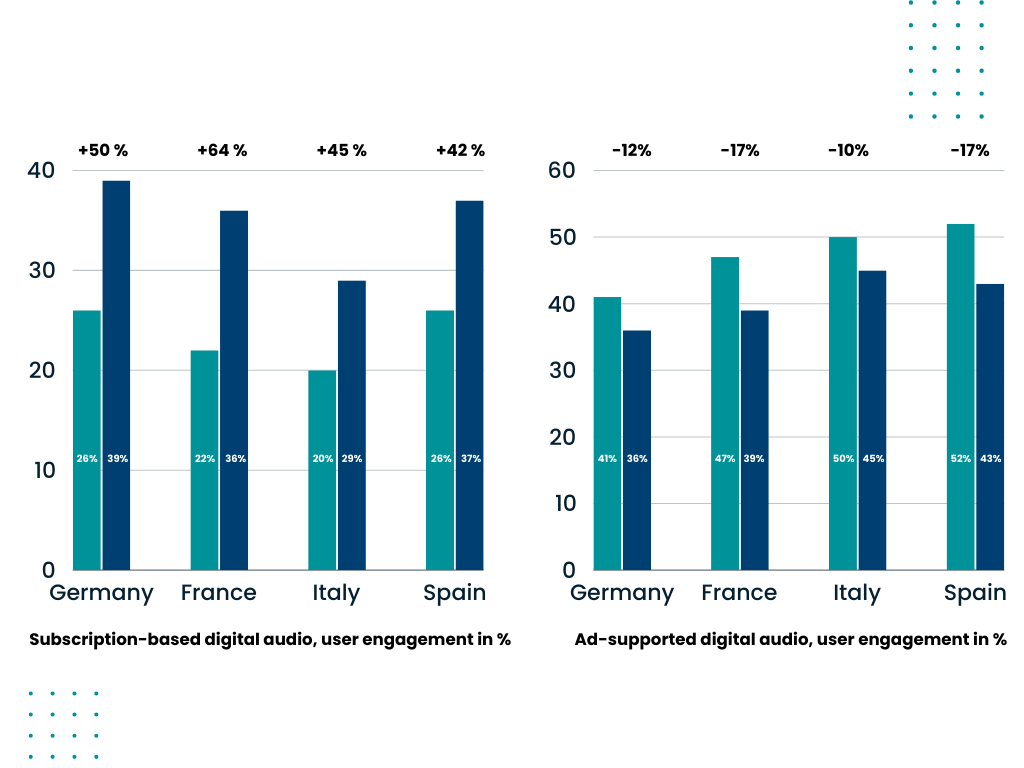

Additionally, the conversion rates from ad-supported to subscription-based digital audio services were notably high in European countries such as Germany, France, Italy, and Spain between 2019 and 2022.

In a broader international context, awareness of digital audio advertisements is highest in China, followed by Spain, showcasing diverse regional dynamics in the world of the adoption and impact of digital audio advertising strategies.

Overview of Digital Audio Advertising Market

The digital audio advertising market has been undergoing significant changes, particularly with the rise of streaming services and podcasts.

In 2024, desktop ad spending in this sector reached 23.0%, reflecting a steady commitment to traditional digital platforms despite the growth of mobile. However, the traditional over-the-air radio segment has faced challenges, with notable losses attributed to the increasing preference of podcast listeners for digital formats. The shift towards ad-supported audio time on streaming service platforms and podcasts indicates a clear trend: audiences are moving away from conventional radio and embracing digital alternatives that offer more flexibility and content diversity.

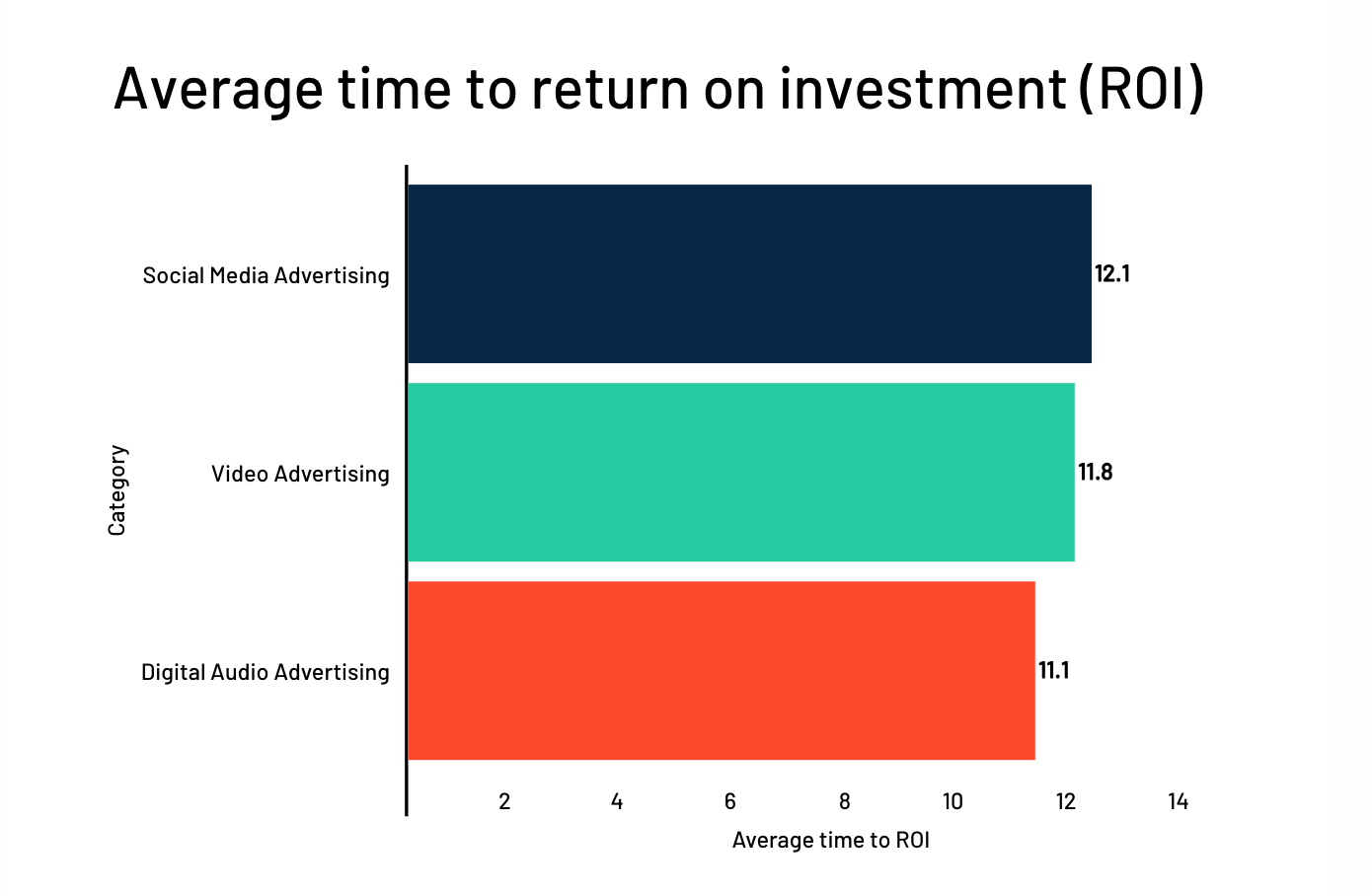

Despite the benefits and the growing prevalence of digital audio advertising, it presents a distinct challenge in terms of return on investment (ROI) when compared to other digital advertising formats.

According to data from G2, the ROI for digital audio advertising software tends to be lower than that for social media and video advertising software.

Although the gap in performance is relatively slim, it highlights an important consideration for marketers—that familiar and extensively used advertising methods like social media and video may require less time to achieve successful outcomes. The average time to realize a full ROI, as reported by G2's review form, offers crucial insights into the effectiveness low cost and efficiency of different advertising tools, shaping how businesses allocate their advertising budgets and strategize their campaigns in an increasingly digital landscape.

Key Trends Shaping the Industry

The digital audio advertising market is poised for significant growth, shaped by evolving technologies and changing consumer behaviors.

According to Statista, the total projected ad spending for the audio advertising market in 2023 is expected to reach an impressive $38.75 billion, with traditional radio advertising leading at $28.61 billion. The United States remains the largest contributor in this arena, with ad spending anticipated to hit $18,95 million.

This dominance highlights the substantial impact and opportunities within the U.S. podcast ad market. Furthermore, other key regions such as France, Germany, and the broader Asia-Pacific area are also contributing to this growth, driven by increased ad-supported audio time in streaming and podcasts, even as traditional over-the-air radio faces declines.

The shift from ad-supported to subscription-based digital audio in countries like Germany, France, Italy, and Spain, coupled with a high awareness of digital audio advertisements in China and Spain, underscores a dynamic shift in global audio advertising strategies.

Three emerging trends are notably shaping the future of digital audio advertising.

First, programmatic audio advertising is gaining traction, leveraging technology to automate ad transactions and enhance targeting capabilities. This approach allows advertisers to tailor ads based on listener demographics, location, and behavior, significantly boosting the efficacy and personalization of campaigns.

Secondly, interactive audio advertising is transforming listener engagement, enabling immediate reactions to ads via voice commands on smart speakers, thus enhancing the path to conversion.

Lastly, synchronized audio advertising integrates digital audio with other advertising formats like out-of-home (OOH) to create cohesive and impactful marketing strategies. An example is E.ON’s campaign that linked audio ads with geofenced OOH locations, significantly boosting brand consideration and engagement with potential customers.

These trends highlight the innovative and integrated approaches that are driving growth in the digital audio advertising sector.

Listening Habits and Preferences

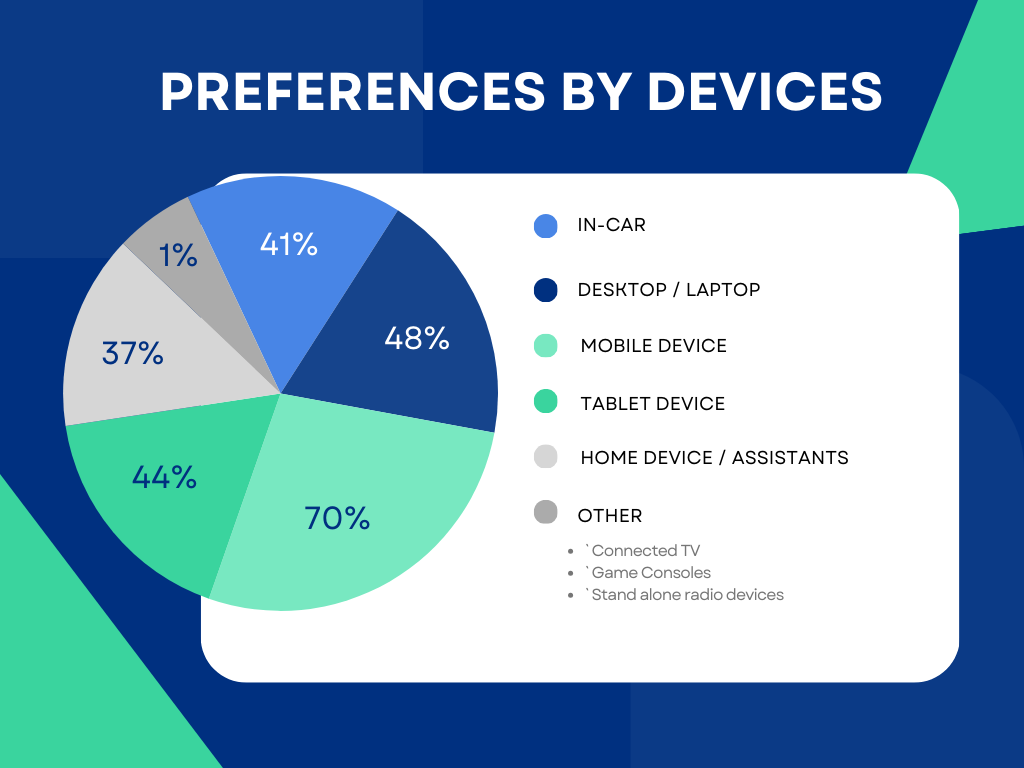

Listening habits and preferences in the audio advertising space reflect a strong inclination towards mobile devices, with 70% of buyers targeting mobile users for their ad campaigns. This preference is mirrored by publishers, 84% of whom also aim to reach their audiences through mobile platforms, emphasizing the significance of mobile in the audio ad market. Desktops and laptops follow, engaged by 50% of buyers, suggesting a balanced approach between mobility and traditional computing.

Other popular platforms include in-car systems and home devices like smart speakers, each utilized by about 44% of buyers, indicating the growing importance of audio ads in everyday life scenarios, whether on the go or at home.

Additionally, there is increasing interest in reaching audiences through emerging technologies such as other connected devices, TVs, game consoles, and standalone radio devices, showcasing a diversification in the ways advertisers and publishers plan to reach listeners captivate listeners across different environments and activities.

Innovations and Future Directions: Evolving Opportunities

The future of digital audio advertising is marked by robust growth and innovation, buoyed by increasing listener engagement and industry readiness to boost investment.

According to recent Rajar data, listener figures for digital audio are at an all-time high, with 78% of industry respondents planning to increase their investment in audio streaming, including radio and music, over the next year, and 75% expressing similar intentions for podcasts. However, the potential for further evolution in audio format remains vast. The development of better measurement and attribution tools, such as DAX’s Listener Insight ID technology, is crucial. These advancements promise to refine how campaign impacts and ROI are gauged, offering clearer insights into digital audio's effectiveness.

Additionally, the integration of innovative technologies is set to propel this medium forward. The adoption of programmatic buying and the expansion of creative opportunities within digital audio are pivotal trends.

Moreover, emerging listener technologies like smart speakers, connected cars, and the continued rise of podcasting are creating new avenues for engaging audiences.

These developments not only enhance listener experiences but also open fresh opportunities for advertisers to achieve significant engagement, ensuring that digital audio remains at the forefront of the advertising landscape.